Serviced accommodations are fully furnished properties that are available for both short and long term let, providing amenities, such as housekeeping and a range of services for guests, and with most utilities and taxes included in the rental price. The introduction of portals such as Airbnb has made it a popular alternative for leisure and business travelers, providing a home away from home. They are an ideal option for property investors to add to their portfolio as with the right location, property and strategy, they have the ability to earn a far higher rental income than standard buy to lets or HMOs.

How to Get Started with a Serviced Accommodation

Unlike a single-let buy-to-let property, serviced accommodation is essentially you letting out a property on a short-term basis. You let out to guests, rather than tenants, as you’re usually charging the property out per night or for other very short amounts of time. The most straightforward way of accomplishing this is to buy a house or property and use it as serviced accommodation. This may be because you have identified a number of factors that indicate that the property would better serve you as serviced accommodation, such as being within walking distance of a popular tourist attraction or destination. However, there are other ways of accomplishing this end goal; though they may require a little more work on your part.

Combining Serviced Accommodation with Rent-to-Rent

If you don’t have the capital to buy the property, an option for you could be combining serviced accommodation with a rent to rent strategy. This means that you rent the property at the fixed going rate from the landlord, then you sub-let the property on a nightly basis as serviced accommodation. This is very attractive to the property owner as they are guaranteed the going rate in rent every month and the stress of managing the property is taken off their shoulders. You could also combine rent to rent with a HMO strategy, which is identical, except you sublet the rooms of the property separately to students or professionals, potentially increasing your profits, if you can ensure those individual rooms are not void for long.

What Could go Wrong?

Rent to rent has the potential for high returns, based on the offer of higher per night income. Shortcomings to this can be that the impetus is very much on you to keep those rooms filled and earning, to maintain some level of consistent month-to-month income. Remember, if you haven’t bought the property – you still owe the landlord his fixed rent.

Keeping this up can start to feel like running a B&B, as serviced accommodations do tend to attract majorly holiday-goers and overnighters. The pressure is on you to fill those rooms for enough nights to pay the landlord and make a profit for yourself to justify the efforts.

Outsourcing Your Serviced Accommodation Management

There is a reasonable standard that needs to be met for your serviced properties to be let. Long story short, you’ll need to clean the apartment and change the linens between guests, and ensure it remains furnished to a good standard to attract a consistent flow of guests. You’ll also need to consider who does the laundry and cleaning, and how the guests can access keys, whether it be through meeting them or a coded safe box situation.

This is where getting a team in to manage your serviced accommodation could come in handy. Whilst providing another cost for you to consider, it does enable you to run the project completely hands-free and receive a steady flow of income. If the property is placed and priced well and priced well, there is no reason why this would eat into your profits negatively. Also, if you set this up across multiple properties, this could allow you a very comfortable income, or even more so, provide capital for bigger projects down the line.

Consider the Council

Another note to consider when planning your serviced accommodation strategy, some local authorities are actively trying to restrict the number of serviced accommodation properties and HMOs in their area, through restrictions on number of days the property can be let out for. London for instance, has the 90 day rule, where a homeowner can’t let their property out on a short-term basis for more than 90 days in a single calendar year, without attaining planning permission from the local council. This isn’t widespread across the country, but nevertheless, is worth looking into before committing to a property in a certain area.

How do I get Started?

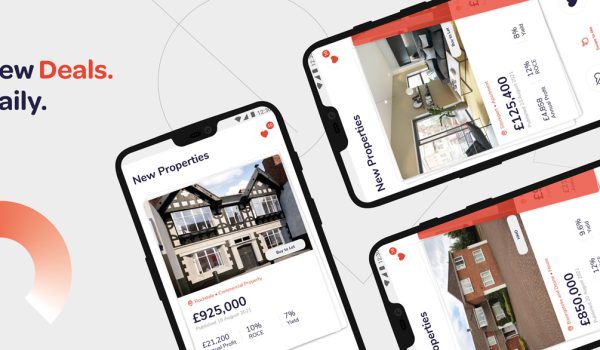

If you’d like to get involved in this, the easiest way to start is to download our Sourced Property Investment App, which hosts a plethora of serviced accommodation deals to invest in. We even outline our due diligence on every property to give you starting numbers to help calculate the rental income needed necessary to afford outside management. Cut out the hard work and download the app to get started.